When we look at the profound influence of technology on industries, the financial services sector stands out as a paramount example. Just over a decade ago, banks, for example, relied on physical branches and paper-based systems, making transactions slow and limiting accessibility. Today, technology has completely reshaped the industry, rendering it almost unrecognisable.

Digital platforms allow transactions from anywhere, contactless payments are prevalent, and cryptocurrencies have challenged traditional models. The most remarkable aspect is how technology integration has not only accelerated banking but also heightened convenience and security to unprecedented levels.

Yet, therein lies a dilemma: The very power and capabilities technology offers are also wielded by nefarious individuals and groups, aiding them in utilising the forefront of technology to obscure laundered money, illicit transactions, or pilfered assets and accounts, thus amplifying the difficulty in their detection, mitigation, and recovery. It becomes an ever-evolving cat-and-mouse game as banks and agencies strive to adapt their technological defences, while cybercriminals continually repurpose and innovate, reshaping their methods to elude detection by evolving the footprints and patterns they leave behind.

Financial Institutions (FIs) not swiftly adapting to evolving technologies or constrained by outdated infrastructures find themselves prime targets, leaving them vulnerable to various financial crimes, including targeted attacks for ransomware, money laundering and other illicit activities.

In a recent interview, Ahmed Drissi, SAS Global Fraud & Security Intelligence Practice, emphasised the potency of “intelligence” as a formidable tool that enables FIs to proactively tackle rapidly evolving threats. Ahmed first highlighted the role of Artificial Intelligence (AI), particularly machine learning, in enhancing detection capabilities, stressing its role in continual improvement. Equally vital was his emphasis on aligning internal and external intelligence—leveraging and interconnecting the data within FIs with external sources—to yield comprehensive insights that enhance and complement internal information.

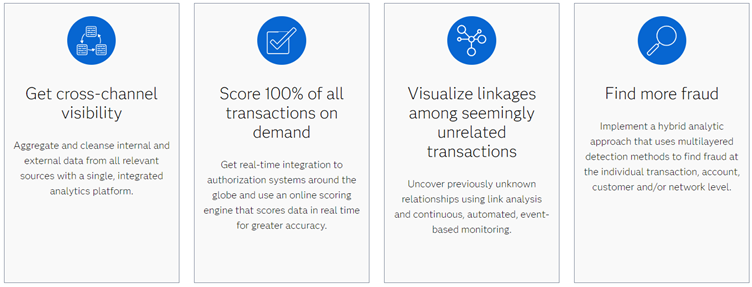

This offers the benefit of enriching the overall intelligence that is so vital for FIs to remain adaptive, resilient and compliant. For instance, in fraud detection, this combined intelligence might reveal intricate networks of seemingly unrelated transactions, uncovering a sophisticated money laundering operation that traditional, rules-based methods might overlook due to their limited scope.

Companies such as SAS, renowned for their analytics solutions translating data into actionable intelligence, play a pivotal role in empowering financial institutions to combat financial crimes more effectively and efficiently. Leveraging the potency of AI, machine learning, extensive anti-financial crime expertise, and a wealth of global field experience, SAS aids in enhancing financial crime detection capabilities.

According to Ahmed, what sets SAS apart is its capacity to complement an organisation’s existing data and tools, enabling a comprehensive view of financial crime risk. Through advanced techniques like entity resolution, pattern matching, and network detection, SAS enables uncovering hidden risks and relationships, bolstering an institution’s ability to mitigate potential threats.

Nevertheless, Ahmed also shared a word of caution for financial institutions, highlighting that any technology deployed, especially AI and machine learning, should not be viewed as a “magic box.” First and foremost, he stressed the fundamental necessity for FIs to “get the basics right” and establish a strong foundation. Otherwise, neglecting these foundational pillars could result in adverse outcomes, encompassing an abundance of false positives, inaccuracies in risk assessments, operational inefficiencies, and a host of other potential pitfalls.

The crucial point to bear in mind is that the battle against financial crime is incessantly dynamic, constantly evolving and demanding perpetual vigilance and adaptation. For financial institutions lacking resources or expertise to combat compliance or fraud issues, SAS stands ready to provide valuable assistance.

For more insights into how SAS can support in this regard, click here.

(0)

(0) (0)

(0)Archive

- October 2024(44)

- September 2024(94)

- August 2024(100)

- July 2024(99)

- June 2024(126)

- May 2024(155)

- April 2024(123)

- March 2024(112)

- February 2024(109)

- January 2024(95)

- December 2023(56)

- November 2023(86)

- October 2023(97)

- September 2023(89)

- August 2023(101)

- July 2023(104)

- June 2023(113)

- May 2023(103)

- April 2023(93)

- March 2023(129)

- February 2023(77)

- January 2023(91)

- December 2022(90)

- November 2022(125)

- October 2022(117)

- September 2022(137)

- August 2022(119)

- July 2022(99)

- June 2022(128)

- May 2022(112)

- April 2022(108)

- March 2022(121)

- February 2022(93)

- January 2022(110)

- December 2021(92)

- November 2021(107)

- October 2021(101)

- September 2021(81)

- August 2021(74)

- July 2021(78)

- June 2021(92)

- May 2021(67)

- April 2021(79)

- March 2021(79)

- February 2021(58)

- January 2021(55)

- December 2020(56)

- November 2020(59)

- October 2020(78)

- September 2020(72)

- August 2020(64)

- July 2020(71)

- June 2020(74)

- May 2020(50)

- April 2020(71)

- March 2020(71)

- February 2020(58)

- January 2020(62)

- December 2019(57)

- November 2019(64)

- October 2019(25)

- September 2019(24)

- August 2019(14)

- July 2019(23)

- June 2019(54)

- May 2019(82)

- April 2019(76)

- March 2019(71)

- February 2019(67)

- January 2019(75)

- December 2018(44)

- November 2018(47)

- October 2018(74)

- September 2018(54)

- August 2018(61)

- July 2018(72)

- June 2018(62)

- May 2018(62)

- April 2018(73)

- March 2018(76)

- February 2018(8)

- January 2018(7)

- December 2017(6)

- November 2017(8)

- October 2017(3)

- September 2017(4)

- August 2017(4)

- July 2017(2)

- June 2017(5)

- May 2017(6)

- April 2017(11)

- March 2017(8)

- February 2017(16)

- January 2017(10)

- December 2016(12)

- November 2016(20)

- October 2016(7)

- September 2016(102)

- August 2016(168)

- July 2016(141)

- June 2016(149)

- May 2016(117)

- April 2016(59)

- March 2016(85)

- February 2016(153)

- December 2015(150)